As elaborate fraud is rife, JPMorganChase is leading the largest fraud and scam prevention effort in the bank’s history, highlighting free consumer education, advanced technologies and support teams to help reduce fraud attacks.

Jennifer Roberts, CEO of Chase Consumer Banking said rallying banks, technology companies, social media platforms, and law enforcement is crucial as they all have a role to play to protect consumers from these unsuspecting scams. She continued to say JPMorganChase are hoping to “lead by example” in their investment of billions into new solutions whilst leading an industry-wide call for action.

On this International Fraud Awareness Week, Chase will host more than 20 educational workshops nationwide across the States, coordinating with local law enforcement and other local partners to increase the public’s awareness.

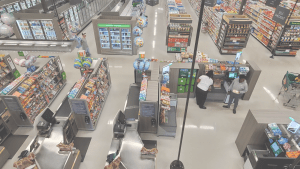

They are free and open to the public, with multi-layered approaches to fraud and scam prevention. Chase regularly hosts fraud and scam prevention workshops across its more than 5,000 of its branches.

Customers are encouraged to report and ignore suspected fraud attempts and visit one of the Chase branches in 48 states if it’s viable.

Just last year, Chase successfully stopped losses of $12 billion in fraud and scam attempts. If a transaction flags a fraud alert, customers may receive an in-app warning or payments may be stopped altogether to safeguard customers.

Chase staff are also trained on assisting the public, especially elderly and vulnerable people who might be victims of financial abuse.

Chase’s dedicated Scam Interruption team was developed by behavioral psychologists, investigators, and global scam prevention research. This team of skilled associates reaches out to connect with clients, providing support during stressful and impactful moments, and works to stop scams in real time.

JPMorgan Chase’s biggest-ever fraud and scam prevention drive featuring real-time alerts, a trusted-contact option, and an intervention team speaks directly to Identity Week Europe 2026 themes of challenging online fraud, scaling verification and authentication, digital ID in finance, and secure KYC. With identity at the centre of preventing financial crime, Identity Week Europe 2026 will explore how behavioural insights and layered verification can build safer, more trusted identity ecosystems.